Business vehicle depreciation calculator

You can deduct the entire 65000 in 2020 thanks to the 100 first-year bonus depreciation privilege. Depreciation on the New Vehicle.

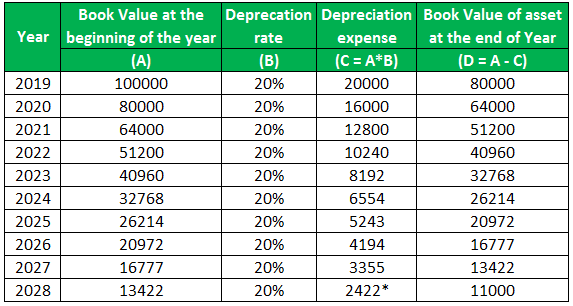

Depreciation Schedule Template For Straight Line And Declining Balance

Business vehicle depreciation is a complex subject but it could lead to substantial deductions for your business at tax time.

.png)

. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment. The tool includes updates to. If you use the actual expenses method and the vehicle was acquired new in 2021 the maximum first-year depreciation deduction including bonus depreciation for an.

The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. R10 99583 x 11 x 112 R10080. Supports Qualified property vehicle maximums 100 bonus safe harbor rules.

If you use the vehicle only 60 for business your first-year deduction. C is the original purchase price or basis of an asset. Where Di is the depreciation in year i.

Select the currency from the drop-down list optional Enter the purchase price of the vehicle. Enter the purchase price of a business asset the likely sales price and how long you will use the. Alternatively if you use the actual cost method you may take deductions.

All you need to do is. Business vehicle depreciation calculator Friday September 2 2022 Edit. Before you use this tool.

Adheres to IRS Pub. Under this method the calculation of depreciation is based on the fixed percentage of its cost. It is fairly simple to use.

For instance a widget-making machine is said to. Rental property depreciation calculator. The MACRS Depreciation Calculator uses the following basic formula.

The calculator also estimates the first year and the total vehicle depreciation. Business vehicle depreciation calculator. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

Im dealing with a. Free MACRS depreciation calculator with schedules. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

Vehicle bought on 1 April 206 during the financial year therefore 1 month of depreciation. Find out how here. Cost of Running the Car x Days you owned 365 x 100 Effective life in years Lost Value.

510 Business Use of Car. Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years. Input the current age of the vehicle - if the car is new simply.

Years 4 and 5 1152. This calculator is for illustrative and educational purposes. Year 1 20 of the cost.

According to the general rule you calculate depreciation over a six-year span as follows. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to. D i C R i.

Free Macrs Depreciation Calculator For Excel

Car Depreciation Rate And Idv Calculator Mintwise

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculator

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Car Depreciation Calculator

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator Irs Publication 946

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Macrs Depreciation Calculator Irs Publication 946

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Of Vehicles Atotaxrates Info

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Depreciation Calculator Depreciation Of An Asset Car Property